Creditas financial results Q3-2023

São Paulo, 13th November 2023

Context of the business

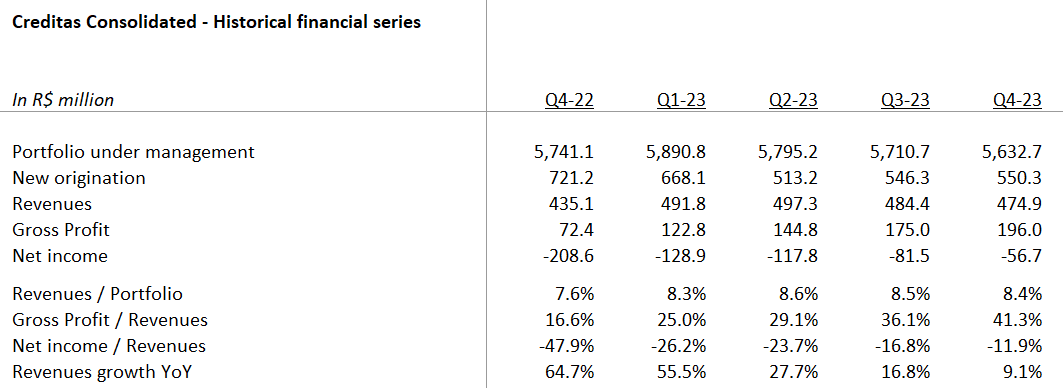

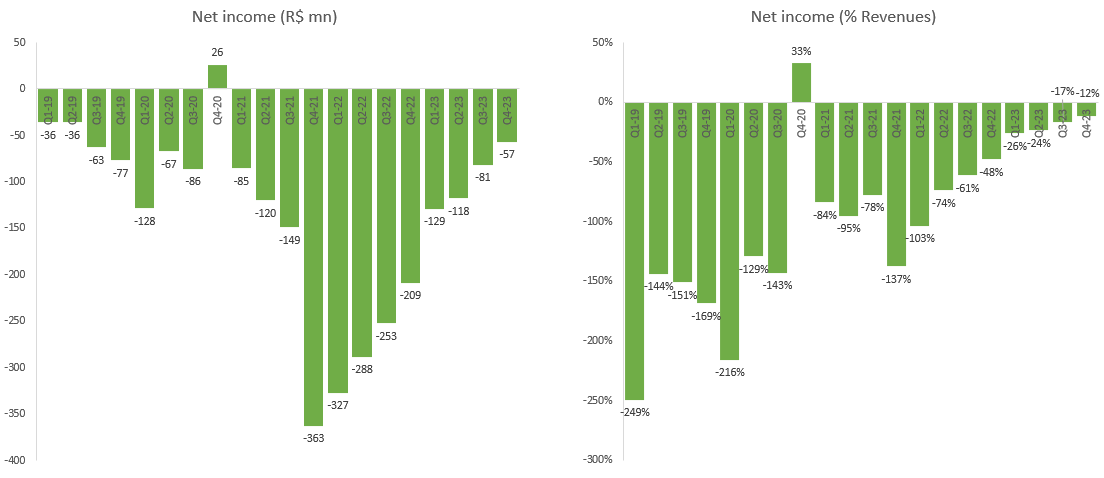

In Q3-23, we posted revenues of R$482.3mn, a 16.3% increase compared to Q3-22 as we continue focusing on more moderate growth to become a profitable company by year end. Focusing on the financial margin and tight monitoring of credit quality are allowing us to progressively improve gross profit. Although still far from our steady state, gross profit in Q3-23 at R$170.9mn represents a 219% increase vs. Q3-22. Gross Profit Margin as a % of revenues has moved in 15 months from 12.1% to 35.4% as we benefit from stable SELIC rates, continued repricing of our loan book and the high quality of our credit portfolio. Costs below Gross Profit decreased compared to last quarter to R$252mn (-18% vs Q3-22) as we continue reducing CAC and gaining operation efficiency in the corporate structure, offsetting increases in financial expenses and lower tax credit related with operating losses . The gross profit expansion associated with continued improvements in costs keeps us on track to narrow net losses and achieve operational profitability by year end. As we previously mentioned, we expect Gross Profit margin to continue normalizing towards our 40-45% steady-state.

In Q3-23 we also completed 2 transactions to strengthen our capital structure: (i) a $75mn equity convertible note with broad based support from our equity investors and a (ii) a $40mn European bond. This senior unsecured bond opens up a new source of funding for Creditas and is a testament of how, approaching profitability, we can fund our growth through different mechanisms to optimize our equity structure.

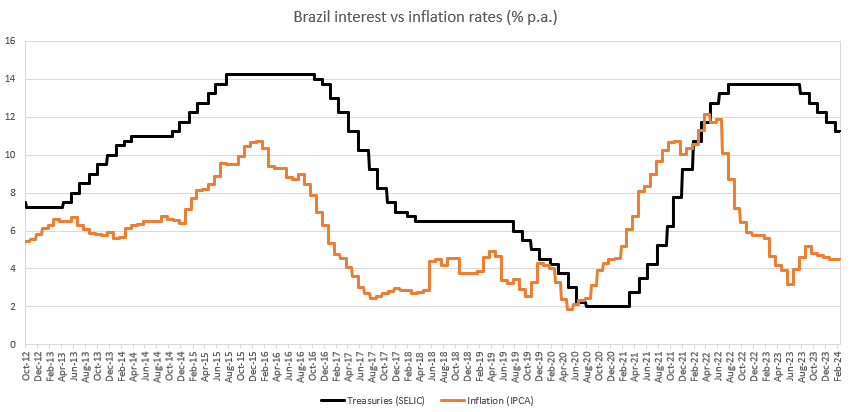

On the macro side, expectations for 2023 inflation continues falling with IPCA September reading at 5.19% for the last 12 months (inflation peaked at 12.13% in Apr-2022). The market has further reduced its expectation of year end inflation from 4.84% to 4.63% in 2023 and slightly increase for 2024, from 3.86% to 3.90%. After one more drop of 0.5% materialized on Nov 1st, SELIC is expected to be at 11.75% by year-end (currently at 12.25%) and 9.25% by the end of 2024. BRL has regained strength against USD, reaching 4.89, reflecting the steady decrease in Brazilian interest rate, while the American economy faces a slowdown in the labor market.

After 3 quarters of stable SELIC, Q3-23 was the first quarter with a falling interest rate, which intensified our ability to raise the Gross Profit margin, since new repriced loans based on higher Selic levels keep replacing older lowered-priced loans. Credit quality continued strong in Q3-23 with cost of credit at the lowest level since 2021. Increase conversions while keeping a cautious approach on the credit side, gain operational efficiency and recover credit margins continue to be our top priorities at the expense of growth.

Following is an update on the action plan we designed:

1. Keep portfolio growth high and sustainable: our portfolio remained almost stable vs a year ago (3% increase yoy), reflecting the tighter underwriting and a less aggressive approach to growth. We continue balancing growth and profitability so that portfolio growth provides future gross profit while keeping our eyes on the negative short-term impact related to growth (IFRS provision frontloading and customer acquisition cost).

2. Accelerate repricing of loan portfolio: pre-fixed loan pricing for new origination has increased to 62%, 1bps above Q1-23 and significantly higher than the 32% we saw in Q3-21. Consequently, pricing of our pre-fixed portfolio has increased, from 32% in Sep-21 to 48% in Sept-23 (45% in Jun-23). This trend will continue through 2023 as the decay of our pre-fixed portfolio is replaced by newer loans at new rates, accelerating gross profit expansion.

3. Increase gross profit: after gross profit compression during the second half of 2021 and early 2022 due to high growth (IFRS provisions impact) and rising interest rates (funding cost impact), we are now experiencing the reverse effect with gross profit margin expanding from 12.1% in Q2-22 to 35.4% in Q3-23 (28.4% in Q2-23). We expect this trend to continue through 2023 and 2024 as we regain 40%+ gross profit margins. The combination of loan repricing, a growing portfolio, stabilized cost of funding and lower IFRS provision impact creates significant tailwinds for profitability. As we will discuss later in this document, despite record-high inflation and interest rates, we have not seen a significant deterioration of credit quality and our portfolio remains highly resilient. We expect the impact of the cycle to remain minor in our gross profit due to the presence of collaterals in all our financial products, something that we are already seeing as part of continuous cost of credit reduction for the fifth consecutive quarter since Q2-22.

4. Acquisition of Andbank’s Brazilian banking operations: after signing the acquisition agreement in July 2022, Andbank completed the capital increase following the authorization from both Brazilian and European authorities, strengthening the balance sheet and accelerating deposit growth. The acquisition is in the process of approval by the Brazilian Central Bank.

5. Reduction of customer acquisition cost: we have managed to bring our customer acquisition cost to the minimum level ever thanks to (i) the impact of our automation efforts in both lowering acquisition costs and increasing conversion and (ii) returning users and repeating customers now representing most of our new loan origination. In addition, as our portfolio grows and loan repricing materializes, CAC represents a significantly lower portion of our revenues. On the other side, as we maintain tight credit policies and higher prices, we are facing some headwinds to further lower our CAC as conversion of our leads fall.

6. Rationalizing our overhead: with significantly reduced hiring after March 2022, we continue increasing productivity per employee and expect to continue gaining operational leverage during 2023.

7. Migration of Creditas Auto business model: After the change in the business model of Creditas Auto, we have focused on (i) reducing the existing inventory of cars which is now very close to zero and (ii) implementing our new C2C model (purchase of cars between individuals). We are seeing good initial traction on this new model but there are still many things that we need to develop to gain scale in the model.

Financial results

Quarterly results for the period Q3-2022 through Q3-2023

Operating performance

Q3-2023 revenues posted R$482.3mn compared to R$414.7mn in Q3-2022, a 16% increase despite the reduction in portfolio growth rates (3% YoY growth) and lower origination volumes (R$546mn in Q3-23 vs 948 in Q3-22). Portfolio under management reached R$5,711mn compared to R$5,537mn in Q3-2022.

We continue to be very restrictive in our Auto Finance product while mostly keeping our standard policies in Car Equity, Home Equity and Private Payroll loan products where we are seeing low volatility at this point in the cycle. Given the low loan-to-value of these products, we believe our product category is ideal to maintain resilience in the current environment.

After seeing our Gross Profit margins bottoming in Q2-2022 due to the impact of the sharp increase in SELIC and the impact of IFRS provisioning frontloading related to our high growth strategy, we are experiencing an acceleration in Gross Profit, which has increased 192% since Q2-2022 from 12.1% to 35.4%. Gross Profit benefited both from continuous loan portfolio repricing and lower cost of credit as our portfolio continues to remain resilient in current market conditions.

As a reminder, our Gross Profit margin is neutral to the level of interest rates in the economy but has compression and expansion depending on the speed of change in interest rates (impacting cost of funding while loan repricing lags due to the duration of our loan products) and speed of growth (impacting IFRS provisioning frontloading). The upward trend in Gross Profit started in Q2-2022, coinciding with SELIC rate reaching 13.75% after bottoming in Q1-2020 at 2.00%, and will continue during 2023 and 2024, to bring us back to our 40%+ steady-state Gross Profit margins. Decreases in SELIC rate will accelerate this return to historical average margins, which could start to be seeing in Q3-2023. As we mature as a company, we are creating the mechanisms to eliminate this fluctuation of margins in the long term by (i) issuing pre-fixed funding notes, (ii) increasing the portion of the portfolio with natural rate matching and (iii) having a clear framework to decide on the hedging of potential interest rate mismatches. We expect credit quality to remain strong during this part of the cycle, with additional tailwinds as the situation normalizes, interest rates trending down and unemployment remains under control. The unemployment rate, which hovered at 12-15% in 2016-2021, has achieved the lower level since 2015 in Q3-23 at 7.7%.

Over the last 12 months we have been able to increase gross profit from 13% to 35% (R$54mn to $171mn) thanks to portfolio repricing while keeping credit cost stable. We are optimistic about continuing these trends over the coming quarters towards our target steady state of 43% as our newly originated loans at higher prices increase the average portfolio profitability. The new phase of lowering SELIC will accelerate this process and we expect to be running at our steady-state gross profit levels in 2024.

In the chart below we overlap interest rates (SELIC) and inflation rates (IPCA). In the previous monetary cycle, when inflation reached 10.71% in 2016, SELIC stayed at 14.25% for 14 months; it took the BCB 9 months since inflation’s peak to start the interest rate reduction cycle. In the present cycle, it took 15 months since inflation peaked (12.13% in Apr-2022) to the BCB to start reducing interest rates, even after inflation had fallen to below 4%. Now, we expect this trend of falling interest rates to continue.

Below Gross Profit we recognize 3 types of costs: (i) Customer Acquisition Costs (CAC) that, despite generating gross profit over many years due to the long-term nature of the loans we originate, we recognize upfront, (ii) overhead costs, mostly related to product technology, a cost that unlike some incumbents, we do not currently activate and (iii) other financial income and expenses, as well as income taxes. As we continue building our portfolio, the impact of both CAC and overhead comes down on a relative basis as we get operational leverage thanks to scale. We expect to reduce both costs significantly over the next quarters as we continue growing our revenues and gross profit margins well above the evolution of CAC and overhead. All in, our path to profitability is related to (i) expanding gross profit related to stabilization of SELIC, portfolio repricing and lower impact of frontloading IFRS provisions, (ii) lower impact of customer acquisition cost as portfolio builds and we get higher efficiency in acquiring customers through our own user base and (iii) operational leverage as we continue growing our revenue base to absorb existing overhead that will grow at a significantly lower pace.

In Q3-23 we have continued to reduce both CAC and G&A costs, adapting to the new environment and with a clear focus of doing more with less. Costs below Gross Profit have come down to R$252mn in Q3-23 from R$306mn in Q3-22, a testament of the team’s focus on increasing productivity and efficiency. Our slower growth strategy for 2023 is helping us to bring efficiency to our operation as we switch focus from hyper-growth (210% year on year growth in Q2-22) to moderate growth at this point of the cycle (16% year on year growth in Q3-23). We are investing our time in creating a new growth framework which will help us obtain profitability and growth simultaneously when we turn the corner of the credit cycle in late 2023 to early 2024. We have been reviewing every aspect of our decision-making process, to clearly align on how to prioritize the funds we spend in both distribution and technology development.

Thanks to this discipline around expenses, and despite the gross profit compression experienced with the increase of interest rates, we have been able to reduce our net losses from R$363mn in Q4-2021 to R$81mn in Q3-23. As we accelerate the expansion of gross profit and continue gaining operational leverage, we are confident that we will reach profitability by the end of 2023 and continue with profitable growth in 2024.

***

Definitions

We present all our financials under IFRS (International Financial Reporting Standards). The key definitions of our financial and operating metrics are below:

Portfolio under management – Includes (i) Outstanding balance of all our lending products net of write-offs and (ii) outstanding premiums of our insurance business. Our credit portfolio is mostly securitized in ring-fenced vehicles and funded by both institutional and retail investors. Our insurance portfolio is underwritten by 14 insurance carriers.

New Origination – Includes (i) volume of new loans granted and (ii) net insurance premiums issued in the period. If new loans refinance outstanding loans at Creditas, new loan origination reflects only the net increase in the customer loan.

Revenues - Income received from our operating activities including (i) recurrent interest from the credit portfolio, (ii) recurrent servicing fees paid by the customers from the credit portfolio related to our collections activities, (iii) up-front fees charged to our customers at the time of origination, (iv) take rate of the insurance premiums issued, (v) other revenues from both lending and non-lending products. (Note: before Q2-2023 we were reporting revenues from cars sold which, giving the change in strategy, are not been included since Q2-2023 anymore; past numbers before Q2-2023 have been restated to make the series comparable).

Gross Profit- Gross Profit calculation adds or deducts from our revenues (i) funding costs of our portfolio comprising interest paid to investors, (ii) cost of credit including credit provisions and write-offs related to our credit portfolio which, under IFRS, are significantly frontloaded to account for future losses and (iii) margin obtained from the sale of cars.

Net Income - Net income deducts from our Gross Profit (i) costs of servicing our portfolio, including headcount, (ii) funds’ operational costs (e.g., auditors, rating, administration fees, etc.), (iii) general and administrative expenses, including overhead, (iv) customer acquisition costs, (v) taxes, and (vi) other income and expenses. We currently don’t activate any of our technology investments which include third party providers, third party platforms and salaries of our product technology team.

Subscribe for

updates

Receive all our news in your email