Creditas financial results H1-2022

São Paulo, 4th October 2022

Context of the business

We are announcing our H1-2022 results fully migrated to IFRS and after reconciling previously published result releases. In the first half of 2022 we posted revenues of R$846mn, 248% increase compared to same period of 2021 and same result obtained in the full year 2021, maintaining our position as a high growth company.

Many things are happening in a challenging and exciting 2022. We kicked-off the year in January with our $260mn Series-F led by Fidelity, VEF and QED and participation with all our major investors. Our main objective with this round was to deliver yet another high growth year with target top-line growth in line with our +236% growth of 2021 to continue growing market share. In February, however, we read a different market situation:

Internationally: (i) raising inflation pressures were pointing to a new high-interest rate environment in USA, (ii) with higher interest rate prospects, valuations of publicly traded tech-companies tanked as cash flows were being expected many years in the future, (iii) with lower publicly traded peer multiples, late-stage private funding would be pressured as valuations would need to be adjusted.

In Brazil: (i) inflation was remaining high in Q1-2022 forcing the Brazilian Central Bank to continue with interest rate hikes that had already raised from 2.00% in Feb-21 to 9.25% in Dec-21 (SELIC ended up raising from 9.25% to 13.75% between Feb-22 and Sep-22), (ii) with these subsequent hikes, our margins would be further compressed as part of our portfolios are pre-fixed while all our funding sources were floating, (iii) Brazilian fintech multiples of publicly traded companies were adjusting even faster than US-based peers due to both macro and company-specific issues, (iv) macro environment putting pressure on consumers that could deteriorate credit quality.

In the purest “don’t let a crisis go to waste” style, we decided to quickly adapt to this new environment and accelerate our path to profitability while remaining a high growth tech company. In our case, this meant focusing on reverting gross profit margins, keeping annual growth at 2x instead of 3x, rationalizing our structure and rethinking our most cash-consuming projects.

Over the past 7 months we have been working very hard on several fronts while talking to investors in order to get feedback on where the ecosystem would emerge in the future. Investors of all types (private equities, public equities, and fixed income) cheered our strategy and pointed to successful companies needing to prove the resilience of their business models and excel in execution.

The key actions we have undertaken since March include the following:

1. Keep portfolio growth high and sustainable: in 2021 our portfolio grew 3x, with R$3bn loan origination in the same period. Although H1-22 portfolio growth is still at very high 2.5x vs. H1-21, we have already taken actions to a more moderate growth in H2-22. High portfolio growth helps us building future gross profit but at same time impacts short term results due to frontloading of IFRS provision and customer acquisition cost.

2. Accelerate repricing of loan portfolio: approximately 70% of our portfolio has pre-fixed rates while all our funding sources are floating. In a raising interest rates environment, we tend to experiment financial margin compression, while in a lowering rates environment, we tend to expand margins. Between Sep-21 and Sep-22 we have been able to pass on to consumers a price increase from 32% p.a. to 49% p.a.* with no significant drops in conversion as competing unsecured products are more expensive than ever. However, due to the long-term nature of our loans (4-year average maturity for pre-fixed loans and 15-year for floating loans) our average portfolio pricing has only increased from 32% p.a. to 40% p.a. which creates a strong backlog of portfolio price increase over the next 12-18 months for an additional 9% spread to build gross profit expansion, something that could even accelerate with SELIC reductions in H2-23.

3. Increase gross profit: after gross profit compression during second half of 2021 and early 2022 due to high growth (IFRS provisions impact) and raising interest rates (funding cost impact) we are now experiencing the reverse effect with gross profit margin expanding in Q3-22. We expect this trend to continue through 2022 and 2023 to regain 40-50% gross profit margins. The combination of loan repricing, growing portfolio, stabilized cost of funding and lower IFRS provision impact create significant tailwinds for our profitability. As we will discuss later in our financial performance, despite record-high inflation and interest rates, we have not seen a significant deterioration of credit quality and our portfolios remain highly resilient. We expect the impact of the cycle to remain minor in our gross profit due to the presence of collaterals in all our financial products.

4. Acquisition of Andbank’s Brazilian banking operations: after many years discussing internally about the possibility of acquiring a full banking license, we have found the right partner and, in July, we signed an agreement to acquire Andbank Brazil subject to approval of the relevant authorities. This banking license shouldn’t be seen as a change on our business model, as we don’t intend to develop day-to-day banking capabilities; the transaction is mostly focused on our funding strategy. Our core funding will continue being our efficient capital markets securitization in which we partner with institutional and retail fixed income investors to provide them access to our superior financial assets. Now, with the full bank license, we will gain flexibility to fund a portion of our loan portfolio (mostly shorter-term maturities) with low-cost deposits. We believe that the combination of institutional fixed income, retail fixed income and now bank deposits provide us with a diversified and optimized funding strategy to continue with our growth.

5. Reduction of customer acquisition cost: we have managed to bring our customer acquisition cost to the minimum level ever thanks to (i) the impact of our automation efforts in lowering acquisition cost and increasing conversion and (ii) returning users and repeating customers now representing the majority of our new loan origination. In addition, as portfolio grows and loan repricing is materialized, CAC represents a significantly lower portion of our revenues.

6. Rationalizing our overhead: In Q4-21 and Q1-22 we prepared ourselves to higher growth than the one we are currently targeting. Since March, we have been optimizing current staffing with significantly lower hiring efforts and a strong focus on productivity and efficiency. Productivity per employee has increased 65% since the beginning of the year and is now 360% higher than our level in Jan-2020 as we gain operational leverage, and our tech efforts pay off.

Financial results

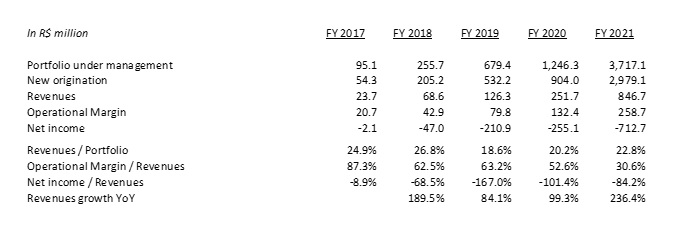

Annual results for the years 2017 through 2021

Quarterly results for the period Q2-2021 through Q2-2022

Operational performance

Revenues of H1-2022 posted at record R$846.1mn compared to R$243.3mn in H1-2021, a 248% increase mostly driven by portfolio growth and revenues from new businesses including Insurance and Creditas Auto, our car marketplace. Portfolio under management reached R$5,040mn compared to R$2,006mn in H1-2021, a 151% increase as we accelerated loan origination between Q3-21 and Q2-22.

For the remainder of the year, we expect portfolio to grow at more modest 40-50% annualized rates while we reprice the portfolio related to the higher interest rate environment. This would still yield a 100%+ growth for FY-22 and will build the base for strong growth in FY-23.

Operational margins since mid-2021 are being impacted by 2 factors:

Sharp increase in SELIC initiated in Mar-2021: as approximately 70% of our loans are pre-fixed while 100% of our funding vehicles are floating, we experiment margin compression that is adjusted through the cycle by repricing the new loan origination. It’s worth mentioning that our net financial margins are the same with stable SELIC regardless of the level (spread with low interest rate environment and high interest rate environment are at a similar level) but we do experience margin compression when raising rates and margin expansion when decreasing rates.

Frontloading IFRS provisions with high origination growth: under IFRS we recognize approximately 50% of the future credit losses at the time of origination. This is specifically relevant for a company like Creditas as: (i) loans have an average 6+ year maturity, forcing to recognize provisions related to loans that will generate margin over many years and (ii) fast portfolio growth means that frontloading has a material impact in relative terms compared to the size of the portfolio (the higher the growth, the more the impact on gross profit margin). We have not experienced a significant impact on the quality of our broader credit portfolio, and we believe that Creditas credit quality will remain resilient over the credit cycle.

We target operational margins of 40-45% after considering cost of funding and IFRS provisions. In periods of lowering SELIC, such as 2016-17 and 2019, we experience margin expansion (see margins reaching 70% in 2019 in chart below); conversely, in periods with raising SELIC such as 2020-21, we experience margin compression (see margins reaching bottom of 10% in Q2-22). Growth plays a significant role in short term operational margin results as well, since the higher the growth (i.e. Q3-21 through Q2-22) the higher the impact of frontloading provisions under IFRS.

The chart below shows the bridge between our steady-state operational margin (42%) and our Q2-2022 margin (10%):

14% of contribution margin (44% of the difference) is linked to the evolution of interest rates (mismatch between pre-fixed loans and floating funding sources)

9% of contribution margin (28% of the difference) is linked to our portfolio growth, as IFRS frontloads future credit provisons without any consideration of the credit behavior

9% of contribution margin (28% of difference) is related to aging of our portfolio cohorts above our expected credit losses

Looking forward, in Sep-22 the Brazilian Central Bank pointed to the end of the interest rate raising cycle as inflation is getting under control in Brazil (expectation for inflation to finish 2022 at 6% and below 5% for 2023). Stable SELIC and slower relative growth, coupled with the loan portfolio repricing will move us back to 40-45% operational margin. In a scenario of SELIC starting a new cycle in the 2nd half of 2023, we would benefit from higher margins than our target trend as cost of funding would come down faster than portfolio pricing.

Below operational margin we recognize 2 types of costs: (i) Customer Acquisition Costs that, despite generating gross profit over many years due to the long-term nature of the loans we originate, we recognize upfront and (ii) overhead costs, mostly related to product technology. As we continue building our portfolio, the impact of both CAC and overhead comes down on a relative basis as we get operational leverage thanks to scale. We expect both costs to come down significantly over the next quarters as we continue growing our revenues and operational margins well above the evolution of CAC and overhead. All in, our path to profitability is related to (i) expanding gross profit related to stabilization of SELIC, portfolio repricing and lower impact of frontloading IFRS provisions, (ii) lower impact of customer acquisition cost as portfolio builds and we get higher efficiency in acquiring customers through our own user base and (iii) operational leverage as we continue growing our revenue base to absorb existing overhead that will grow at a significantly lower pace.

* Considering only pre-fixed loans to assess the impact of margin compression.

***

Definitions

We present all our financials under IFRS (International Financial Reporting Standards). The key definitions of our financial and operational metrics are below:

Portfolio under management – Includes (i) Outstanding balance of all our lending products net of write-offs and (ii) outstanding premiums of our insurance business. Our credit portfolio is mostly securitized in ring-fenced vehicles and funded by both institutional and retail investors. Our insurance portfolio is underwritten by 14 insurance carriers.

New Origination – Includes (i) volume of new loans granted and (ii) net insurance premiums issued in the period. If new loans refinance outstanding loans at Creditas, new loan origination includes only the net increase in the customer loan.

Revenues - Income received from our operating activities including (i) recurrent interest from the credit portfolio, (ii) recurrent servicing fees paid by the customers from the credit portfolio related to our collection activities, (iii) up-front fees charged to our customers at the time of origination, (iv) take rate of the insurance premiums issued, (v) total price of cars sold and (vi) other revenues from both lending and non-lending products.

Operational Margin - Margin calculation deducts from our revenues (i) funding costs of our portfolio comprising interests paid to investors, (ii) credit provisions related to our credit portfolio which, under IFRS, are significantly frontloaded to account for future losses and (iii) acquiring and preparation costs of vehicles sold.

Net Income - Net income deducts from our Operational Margin (i) costs of servicing our portfolio, including headcount, (ii) funds operational costs (e.g. auditors, rating, administration fees, etc), (iii) general and administrative expenses, including overhead, (iv) customer acquisition costs, (v) taxes and (vi) other income and expenses. We currently don’t activate any of our technology investments which include third party providers, third party platforms and salaries of our product technology team.

Subscribe for

updates

Receive all our news in your email